In a nutshell, chargeback alerts are notifications sent to merchants to inform them of a pending chargeback on a transaction. These alerts provide an opportunity for the merchant to proactively address the issue before it escalates into a formal chargeback.

By avoiding the chargeback, the merchant can avoid the fees and higher chargeback ratios that could negatively impact their relationship with their payment processors. And, by responding swiftly to chargeback alerts, merchants can potentially resolve disputes directly with the customer, possibly preventing the chargeback from being officially filed.

This system serves as an early warning, allowing merchants to take corrective action to maintain healthy financial and customer relations.

How Do Chargeback Alerts Work?

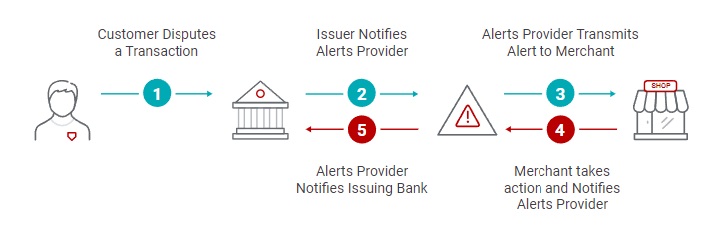

Chargeback alerts rely on a network of payment processors and issuing banks that monitor and flag transactions likely to result in a chargeback.

When a transaction is flagged, an alert is sent to the merchant, typically through a chargeback alert service provider. Upon receiving an alert, the merchant is then provided with pertinent information regarding the transaction, such as customer details and the reason for the alert. This enables the merchant to take timely action to address the underlying issue, such as processing a refund, correcting a billing error, or engaging directly with the customer to prevent a formal chargeback filing.

The effectiveness of chargeback alerts relies heavily on the merchant’s ability to swiftly respond and resolve the issue in cooperation with customers and banks, thus minimizing financial loss and maintaining lower chargeback ratios.

Benefits of Chargeback Alerts for Merchants

Chargeback alerts provide merchants with several key benefits.

First, they offer an opportunity to proactively manage potential chargebacks, allowing merchants to resolve disputes before they escalate. This early intervention can save merchants significant costs associated with chargeback fees, penalties, and increased processing rates.

Also, by reducing the frequency of chargebacks, merchants can maintain better relationships with their payment processors. They can preserve their creditworthiness and reduce the risk of their merchant account being flagged or terminated.

Addressing disputes early also helps enhance customer satisfaction and loyalty by demonstrating a commitment to resolving issues quickly and effectively. Finally, by minimizing the disruptive impact of chargebacks, merchants can focus on their core business activities, improving operational efficiency and overall business performance.

Can Merchants Self-Manage Their Alerts?

Merchants can certainly self-manage their chargeback alerts. This requires a strategic approach and dedicated resources, though.

By using specialized software and employing trained staff, merchants can monitor transaction alerts closely and respond promptly to any potential chargeback disputes. This self-management involves setting up automated systems to receive real-time notifications and instituting procedures for a swift resolution of disputes.

This approach empowers merchants to take proactive measures and reduce dependence on third-party services. But, it demands a commitment to continuous monitoring, staff training, and system updates to effectively minimize financial losses and uphold their reputation with banks and customers.

That’s why the most cost-effective option is usually to work with a chargeback specialist. A third-party provider can help offer more comprehensive access through a single, simplified dashboard. They can also help merchants, and the financial institutions that work with merchants, to interpret chargeback data, fight chargeback abuse, and prevent more disputes from happening in the first place.