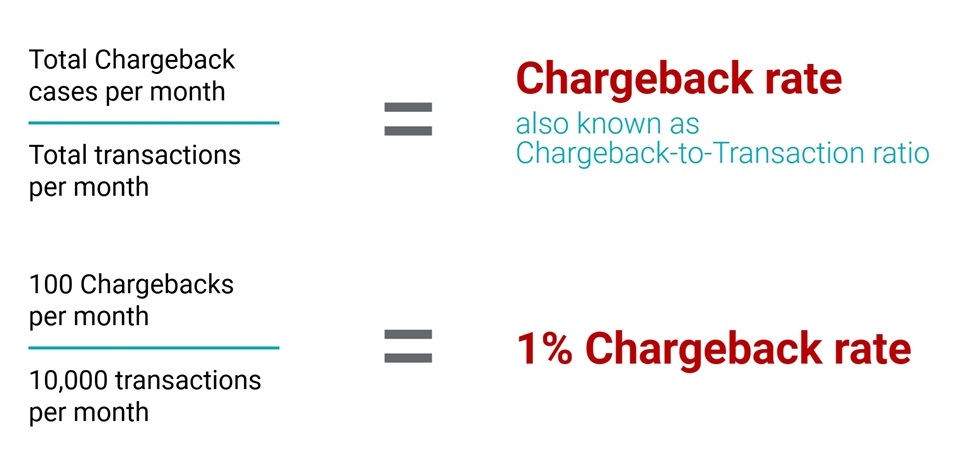

A chargeback rate is a metric that measures the percentage of transactions disputed by customers and ultimately reversed by the merchant’s bank. It is calculated by dividing the number of chargebacks by the total number of transactions within a specific period.

A high chargeback rate can indicate issues like fraud, dissatisfaction with products or services, or misunderstandings in billing. Maintaining a low chargeback rate is crucial for businesses, as excessive chargebacks can lead to increased fees, strained relationships with payment processors, or even the termination of merchant accounts.

How do Merchants Calculate Their Chargeback Rate?

Merchants can calculate their chargeback rate by dividing the number of chargebacks they receive within a specific time frame by the total number of transactions during that same period. The result is then typically expressed as a percentage.

For example, if a merchant processes 1,000 transactions in a month and receives 10 chargebacks, the chargeback rate would be 1%. It is important for merchants to use consistent time frames and data sources when calculating their chargeback rate to ensure accuracy and to monitor trends effectively over time.

Both Mastercard and Visa apply the formula outlined above, which involves dividing total chargebacks by total transactions. However, there’s a key difference: Visa calculates the ratio by dividing the chargebacks received in a given month by the total transactions processed during that same month. Mastercard, however, bases their calculation on the total transactions from the prior month.

Why Does a Merchant’s Chargeback Rate Matter?

A merchant’s chargeback rate is a crucial metric as it directly impacts their financial health and relationship with payment processors. High chargeback rates can lead to increased fees and penalties.

Merchants who cannot get their chargeback rate under control could be forced to pay expensive reporting costs. They may even see the termination of merchant accounts. This makes it essential for businesses to keep their rates low.

Additionally, excessive chargebacks indicate potential issues such as poor customer satisfaction, fraud, or errors in transaction processing. These can harm a merchant’s reputation and profitability. By monitoring and maintaining a low chargeback rate, merchants can protect their operations while fostering trust with both customers and payment processors.

What’s an “Acceptable” Chargeback Rate?

An acceptable chargeback rate typically depends on the card brand, payment processor, and other factors. But, the general industry standard is often considered to be under 1%.

Both Visa and Mastercard, for example, set thresholds for acceptable chargeback rates. A chargeback rate above 0.9% for Visa, or 1% for Mastercard, may result in penalties or inclusion in their respective monitoring programs.

It’s important to note that this percentage is calculated as the proportion of chargebacks relative to total transactions. Staying within an acceptable chargeback rate is essential for avoiding additional scrutiny, fines, or even the termination of a merchant account, which could significantly disrupt business operations.

How Can Merchants Keep Their Chargeback Rate Low?

To maintain a low chargeback rate and safeguard their business, merchants can adopt the following strategies:

- Provide Clear Product Descriptions: Ensure that the product or service descriptions on one’s website are accurate and comprehensive to align customer expectations with what they will receive.

- Offer Excellent Customer Service: Respond to customer inquiries and complaints promptly to resolve any issues before they escalate into chargebacks.

- Use Confirmations and Tracking: Provide order confirmation emails and shipment tracking information to keep customers informed and reduce disputes related to delivery.

- Implement Secure Payment Solutions: Adopt fraud prevention tools like CVV verification, address verification service (AVS), and 3D Secure to mitigate the risk of unauthorized transactions.

- Maintain Transparent Refund Policies: Clearly outline refund and return policies, and honor legitimate refund requests to avoid the customer resorting to filing a chargeback.

- Monitor Transactions Regularly: Keep an eye on unusual or suspicious transactions to identify potential fraud before a chargeback is initiated.

- Educate Staff: Train employees on chargeback prevention techniques and customer handling practices to minimize transaction errors or disputes.

- Keep Records Organized: Maintain detailed records of sales, communications, and transactions to provide compelling evidence in the event of a chargeback dispute.

By implementing these preventative measures, merchants can significantly reduce the likelihood of chargebacks and maintain a healthy business relationship with payment processors and customers.